The accounts of a Balance Sheet using IFRS mightappear as shown here. For example,IFRS-based financial statements are only required to report thecurrent period of information and the information for the priorperiod. The statement of retained earnings (which is often a componentof the statement of stockholders’ equity) shows how the equity (orvalue) of the organization has changed over a period of time. Thestatement of retained earnings is prepared second to determine theending retained earnings balance for the period.

How is the Trial Balance Prepared?

Under both IFRS and US GAAP, companies can report more than the minimum requirements. The statement of retained earnings (which is often a component of the statement of stockholders’ equity) shows how the equity (or value) of the organization has changed over a period of time. The statement of retained earnings is prepared second to determine the ending retained earnings balance for the period. The statement of retained earnings is prepared before the balance sheet because the ending retained earnings amount is a required element of the balance sheet.

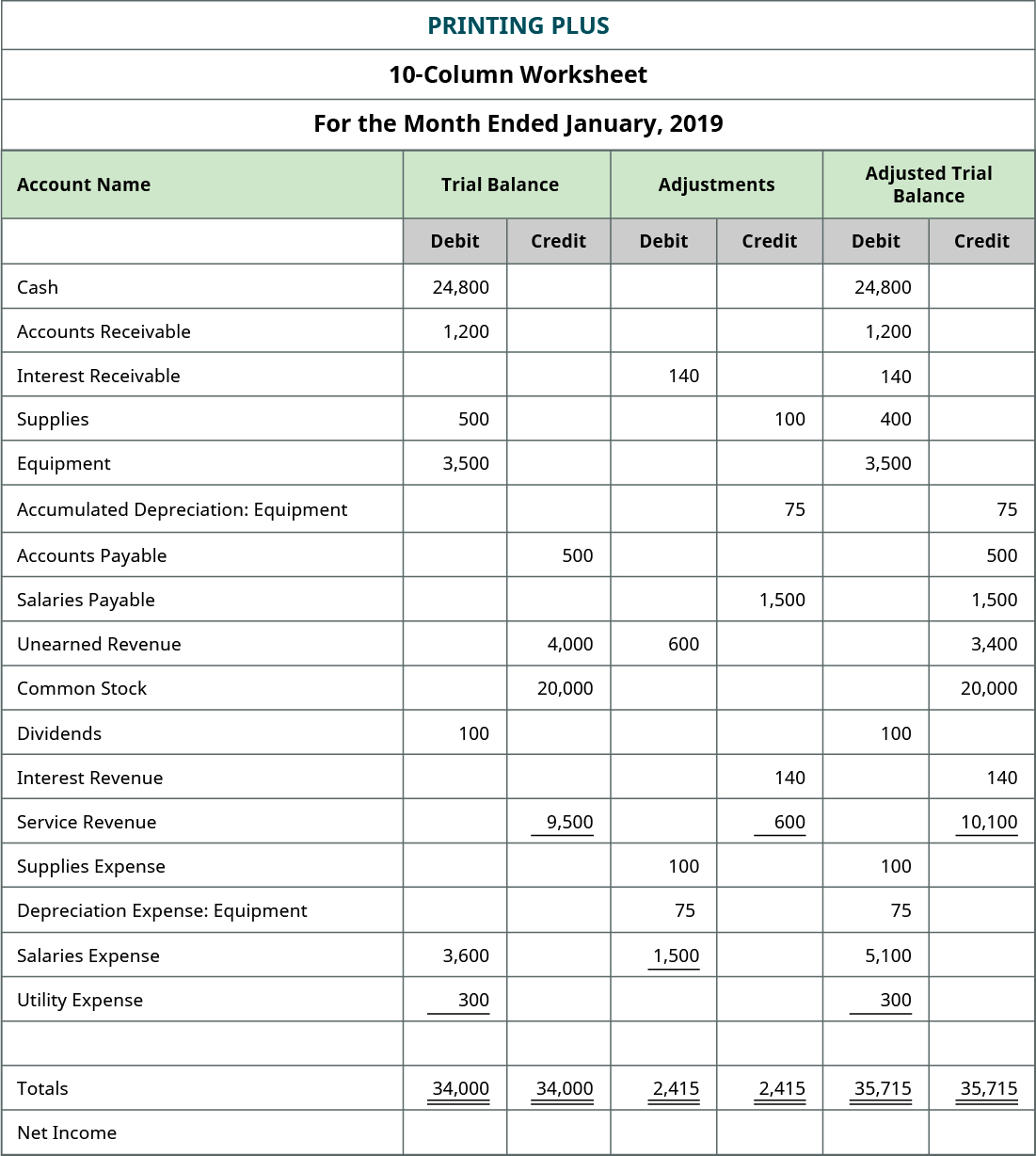

Ten-Column Worksheets

As you can see, the report has a heading that identifies the company, report name, and date that it was created. The accounts are listed on the left with the balances under the debit and credit columns. As the bookkeepers and accountants examine the report and find errors in the accounts, they record adjusting journal entries to correct them. After these errors are corrected, the TB is considered an adjusted trial balance.

Error

Enron defrauded thousands by intentionally inflating revenues that did not exist. Arthur Andersen was the auditing firm in charge of independently verifying the accuracy of Enron’s financial statements and disclosures. This meant they would review statements to make sure they aligned with GAAP principles, assumptions, and concepts, among other things.

When entering net income, it should be written in the column with the lower total. You then add together the $5,575 and $4,665 to get a total of $10,240. If you review the income statement, you see that net income is in fact $4,665. Next you will take all of the figures in the adjusted trial balance columns and carry them over to either the income statement columns or the balance sheet columns. The statement of retained earnings always leads with beginning retained earnings. Beginning retained earnings carry over from the previous period’s ending retained earnings balance.

Unfortunately, you will have to go back through one step at a time until you find the error. Review the annual report of Stora Enso which is an international company that utilizes the illustrated format in presenting its Balance Sheet, also called the Statement of Financial Position. As the name suggests, it includes deductions with respect to the tax liabilities. Here, the adjustment will be $ 80,000.00 as the total salary payable is $ 80,000. My Accounting Course is a world-class educational resource developed by experts to simplify accounting, finance, & investment analysis topics, so students and professionals can learn and propel their careers. Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching.

- Both US-based companies and those headquartered in other countries produce the same primary financial statements—Income Statement, Balance Sheet, and Statement of Cash Flows.

- Concepts Statements give the Financial Accounting Standards Board (FASB) a guide to creating accounting principles and consider the limitations of financial statement reporting.

- An amount must have been entered incorrectly; hence, must be corrected.

- The post-closing trial balance contains real accounts only since all nominal accounts have already been closed at this stage.

- This means the $600 debit issubtracted from the $4,000 credit to get a credit balance of $3,400that is translated to the adjusted trial balance column.

The salon had previously used cash basis accounting to prepare its financial records but now considers switching to an accrual basis method. You have been tasked with determining if this transition is appropriate. The salon had previouslyused cash basis accounting to prepare its financial records but nowconsiders switching to an accrual basis method. You have beentasked with determining if this transition is appropriate.

If total expenses were more than total revenues,Printing Plus would have a net loss rather than a net income. Thisnet income figure is used to prepare the statement of retainedearnings. An income statement shows the organization’s nyc property tax lien sale financialperformance for a given period of time. When preparing an incomestatement, revenues will always come before expenses in thepresentation. For Printing Plus, the following is its January 2019Income Statement.

The preparation of the adjusted trial balance is the sixth step of the accounting cycle. This trial balance is prepared after taking into account all the adjusting entries prepared in the previous step of the accounting cycle. The purpose of the trial balance is to test the equality between total debits and total credits after the posting process. This trial balance is called an unadjusted trial balance (since adjustments are not yet included). A trial balance is a worksheet with two columns, one for debits and one for credits, that ensures a company’s bookkeeping is mathematically correct. The debits and credits include all business transactions for a company over a certain period, including the sum of such accounts as assets, expenses, liabilities, and revenues.

When preparing an income statement, revenues will always come before expenses in the presentation. For Printing Plus, the following is its January 2019 Income Statement. The accounts that have been affected because of adjusting entries for the month of December are shown in red font in the adjusted trial balance.

Phản hồi gần đây