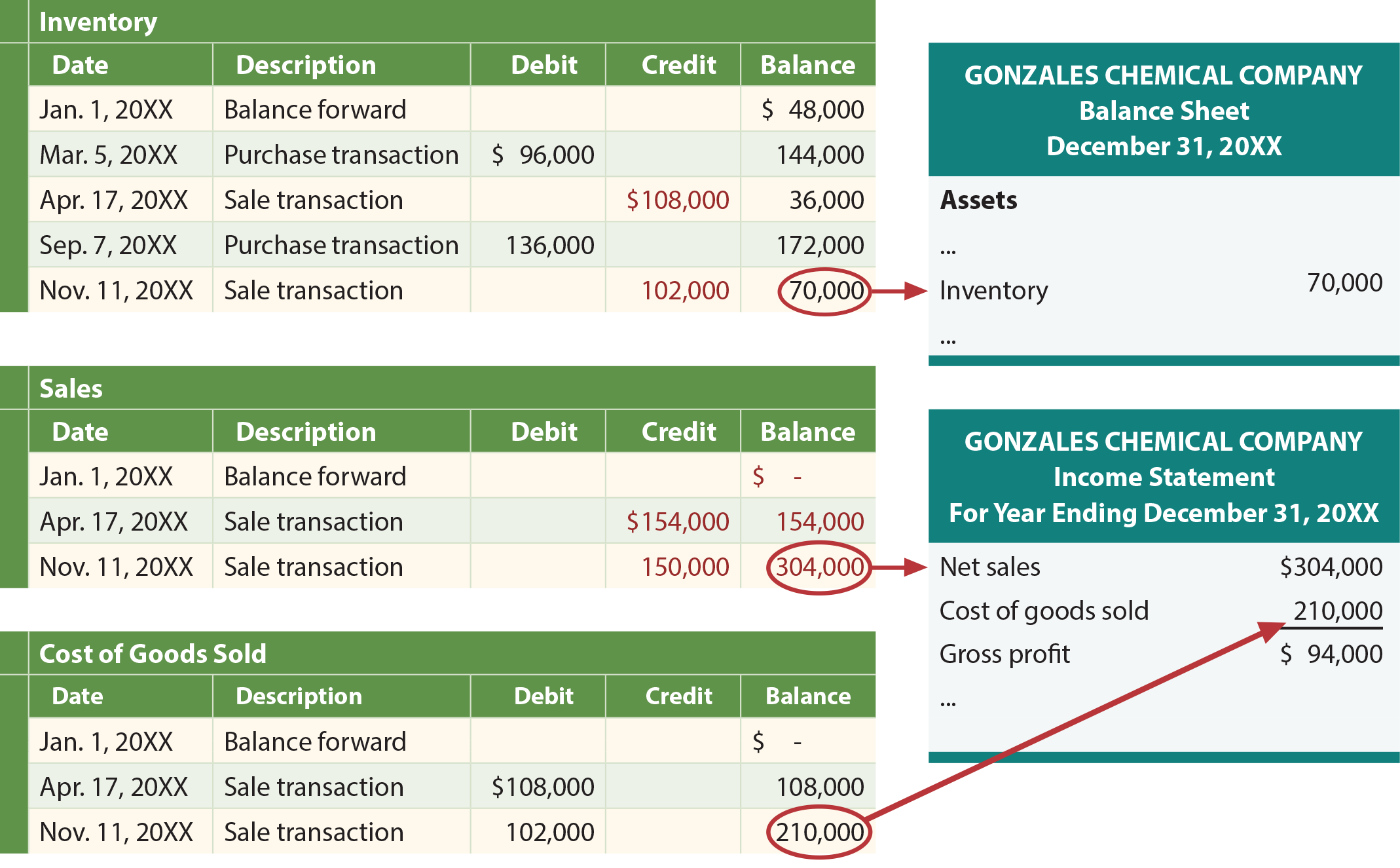

So the inventory left at the end of the period is the most recently purchased or produced. When you sell products in a perpetual inventory system, the expense account increases and grows the costs of sales. Also called the cost of goods sold (COGS), the costs of sales are the direct expenses from the production of goods during a period. These costs include the labour and materials costs but leave off any distribution or sales costs. Inventory management software and processes allow for real-time updating of the inventory count.

Cost of Goods Sold (COGS)

With advancements in point-of-sale technologies, inventory is updated automatically and transferred into the company’s accounting system. This allows managers to make decisions as it relates to inventory purchases, stocking, and sales. The information can be more robust, with exact purchase costs, sales prices, and dates known. Although a periodic physical count of inventory is still required, a perpetual inventory system may reduce the number of times physical counts are needed.

Perpetual vs. Periodic Inventory Systems

A perpetual inventory system uses point-of-sale terminals, scanners, and software to record all transactions in real-time and maintain an estimate of inventory on a continuous basis. A periodic inventory system requires counting items at various intervals, such as weekly, monthly, quarterly, or annually. Companies can choose among several methods to account for the cost of inventory held for sale, but the total inventory cost expensed is the same using any method. The difference between the methods is the timing of when the inventory cost is recognized, and the cost of inventory sold is posted to the cost of sales expense account. Periodic means that the Inventory account is not updated during the accounting period. Instead, the cost of merchandise purchased from suppliers is debited to the general ledger account Purchases.

What Is the Periodic Inventory System?

It can be cumbersome and time-consuming, as it requires you to manually count and record your inventory. It also isn’t as up to date as a perpetual system, as it is done at periodic intervals rather than continuously. But keep in mind, results can differ when more purchases and sales are made throughout the period, especially when prices change. Perpetual LIFO could lead to different COGS and ending inventory values than Periodic LIFO, because it continuously updates with each transaction. With perpetual FIFO, the first (or oldest) costs are the first costs removed from the Inventory account and debited to the Cost of Goods Sold account.

Perpetual Inventory System: Definition, Pros & Cons, and Examples

With perpetual LIFO, the last costs available at the time of the sale are the first to be removed from the Inventory account and debited to the Cost of Goods Sold account. Since this is the perpetual system we cannot wait until the end of the year to determine the last cost (as is done with periodic LIFO). An entry is needed at the time of the sale in order to reduce the balance in the Inventory account and to increase the balance in the Cost of Goods Sold account.

- Under LIFO, you assume that the last item entering inventory is the first one to be used.

- The cost of sales would be determined according to the price of the last purchased items.

- Perpetual inventory is also a requirement for companies that use a material requirement planning (MRP) system for production.

- For example, Ava wants to figure out the average cost to assign for Acetone repackaged in her company’s warehouse.

- The primary case where a periodic system might make sense is when the amount of inventory is very small, and where you can visually review it without any particular need for more detailed inventory records.

- A company may prefer using a FIFO system when it’s trying to show its largest possible profit on its financial statements for investors, lenders and stakeholders.

To determine the value ofCost of Goods Sold, the business will have to look at the beginninginventory balance, purchases, purchase returns and allowances,discounts, and the ending inventory balance. Businesses increasingly track inventory using a perpetual inventory system versus the older, physical-count periodic inventory system. Perpetual systems are costly to implement but less expensive and time-consuming over the long haul. Because perpetual inventory systems lack the ability to account for loss, breakage, or theft, a periodic (physical) inventory can still be necessary.

Under periodicinventory systems, only the sales return is recognized, but not theinventory condition entry. The first in, first out (FIFO) method assumes that the oldest units are sold first, while the last in, first out (LIFO) method records the newest units as those sold first. Businesses can simplify the inventory costing process by using a weighted average cost, or the total inventory cost divided by the number of units in inventory. A perpetual inventory system maintains a continuous tally of transactions, making the COGS available at any time. By contrast, a periodic inventory system calculates the COGS only after conducting a physical inventory. The nature and type of business you have will factor into the kind of inventory you use.

The journal entries are not repeated here but would be the same as with FIFO; only the amounts would change. Cost of goods sold ($1,048) is higher than under FIFO ($930) so that the reported gross profit (and, hence, net income) is lower by $118 ($1,020 for FIFO versus $902 for LIFO). Mayberry Home Improvement Store reports best freelance services in 2021 gross profit using periodic LIFO of $902 (revenue of $1,950 less cost of goods sold of $1,048). FIFO (first in, first out) refers to an accounting system that assumes the oldest products are sold first, followed by newer ones. LIFO (last in, first out) assumes the most recent products are sold before older ones.

There is a gap between the sale or purchase of inventory and when the inventory activity is recognized. The main difference between a perpetual vs periodic inventory system is the timing of when inventory is tracked. A periodic inventory system calculates the COGS following a physical inventory count at period-end, whereas a perpetual inventory system calculates the COGS after each sale. As before, we need to account for the cost of goods available for sale (5 books having a total cost of $440).

The time commitment to train andretrain staff to update inventory is considerable. In addition,since there are fewer physical counts of inventory, the figuresrecorded in the system may be drastically different from inventorylevels in the actual warehouse. A company may not have correctinventory stock and could make financial decisions based onincorrect data. A purchase return or allowance under perpetual inventory systemsupdates Merchandise Inventory for any decreased cost. Underperiodic inventory systems, a temporary account, Purchase Returnsand Allowances, is updated.

Phản hồi gần đây