Since the accounts payable turnover ratio indicates how quickly a company pays off its vendors, it is used by supplies and creditors to help decide whether or not to grant credit to a business. As with most liquidity ratios, a higher ratio is almost always more favorable than a lower ratio. In the case of our example, you would want to take steps to improve your accounts payable turnover ratio, either by paying your suppliers faster or by purchasing less on credit. But there is such a thing as having an accounts payable turnover ratio that is too high. If your business’s accounts payable turnover ratio is high and continues to increase with time, it could be an indication you are missing out on opportunities to reinvest in your business.

You’re our first priority.Every time.

It’s important to consider industry benchmarks and other financial indicators for a holistic understanding. Delayed payments can also strain relationships with suppliers, potentially resulting in less favorable payment terms. Moreover, a consistently low ratio could raise red flags about the company’s creditworthiness, indicating to creditors and investors a potential higher credit risk. Errors in processing accounts payables can be another reason why your business may not have a good accounts payable turnover ratio. A good accounts payable turnover ratio in days (DPO) is determined by benchmarking with your industry and your business. Similarly, the accounts payable turnover ratio can be used by creditors as a way of evaluating the vendor payment history of a company.

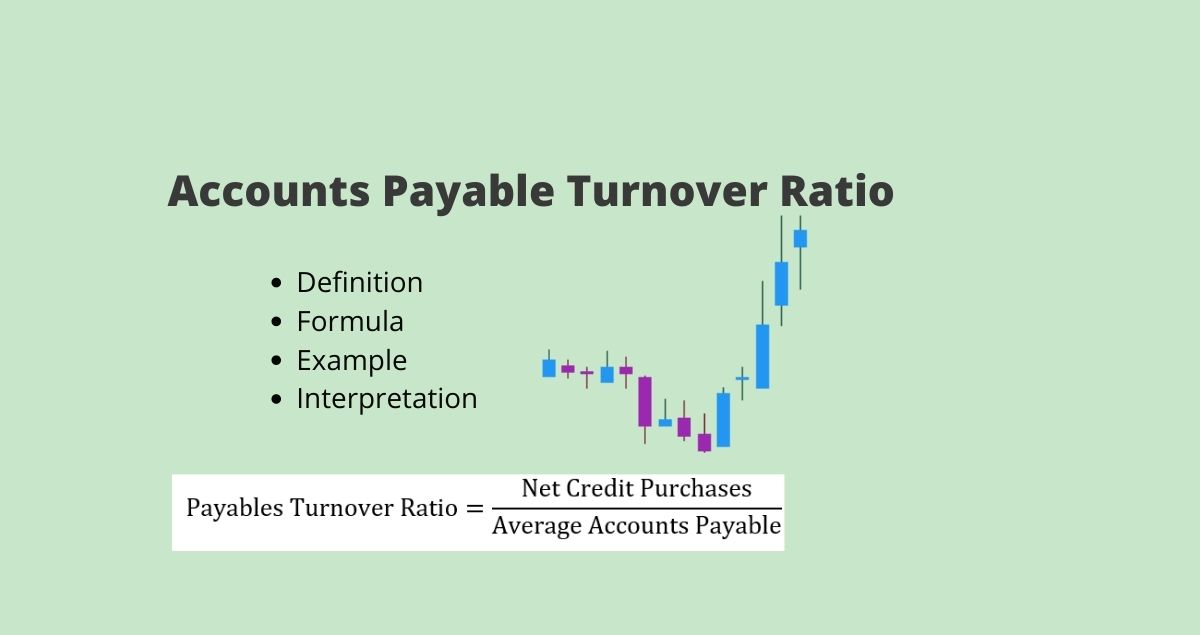

Accounts Payable (AP) Turnover Ratio

Let’s consider a practical example to understand the calculation of the AP turnover ratio. In this guide, we will discuss what the AP turnover ratio is, why it matters, and how to calculate it. Ratios that are good for a grocery retail chain might not have the same meaning for a fashion retail brand.

How Can You Improve Your Accounts Payable Turnover Ratio in Days?

As with all ratios, the accounts payable turnover is specific to different industries. This ratio helps creditors analyze the liquidity of a company by gauging how easily a company can pay off its current suppliers and vendors. Companies that can pay off supplies frequently throughout the year indicate to creditor that they will be able to make regular interest and principle payments as well. Beginning accounts payable and ending accounts payable are added together, and then the sum is divided by two in order to arrive at the denominator for the accounts payable turnover ratio. A decreasing turnover ratio indicates that a company is taking longer to pay off its suppliers than in previous periods.

Financial Strategy Planning

A key metric used in accounts payable analytics is the AP turnover ratio, which measures how quickly a company pays off its suppliers and vendors. The accounts payable turnover in days is also known as days payable outstanding (DPO). It’s a different view of the accounts payable turnover ratio formula, based on the average number of days in the turnover period.

- After analyzing your results and comparing those results to those of similar companies, you may be interested in how you can improve your accounts payable turnover ratio.

- Higher figures indicate that a company pays its bills on a more timely basis, and thereby has less debt on the books.

- Remember to include only credit purchases when determining the numerator of our formula.

- While some aspects may take center stage, others quietly operate beneath the surface, yet have significant influence.

- Conversely, in a booming economy, companies might pay faster due to better cash flow, increasing the ratio.

Low AP Turnover Ratio

But, since the accounts payable turnover ratio measures the frequency with which the company pays off debt, a higher AP turnover ratio is better. It’s essential to compare the AP turnover ratio with industry benchmarks or historical data to assess performance relative to peers or previous periods. A significantly higher or lower ratio than industry averages may warrant further investigation into the company’s payment practices, supply chain efficiency, or financial strategy. To calculate accounts payable turnover, take net credit purchases and divide it by the average accounts payable balance.

Companies can leverage these discounts to reduce costs and improve their AP turnover ratio by paying quickly and more efficiently. Manual AP processes are prone to errors, which can delay payments and adversely affect the AP turnover ratio. Automation reduces the likelihood of errors and speeds up the resolution of any disputes with suppliers. The ratio does not account for qualitative aspects like the quality of the supplier relationship or the nature of goods and services received. Strong supplier relationships can lead to more favorable payment terms, affecting the ratio independently of financial considerations.

Plan to pay your suppliers offering credit terms with lucrative early payment discounts first. Your company’s accounts payable software can automatically generate reports how to do a competitive analysis in 2021 with total credit purchases for all suppliers during your selected period of time. If it’s not automated, you can create either standard or custom reports on demand.

Investors and lenders keep a close eye on liquidity, debt, and net burn because they want to track the company’s financial efficiency. But, if a business pays off accounts too quickly, it may not be using the opportunity to invest that credit elsewhere and make greater gains. Finding the right balance between a high and low accounts payable turnover ratio is ideal for the business.

To compare your ratio with industry averages, calculate your company’s ratio using the formula and compare it with the industry averages. Another strategy that can be implemented to improve the Accounts Payable Turnover Ratio is to regularly review and analyze vendor invoices. This can help identify any discrepancies or errors in billing, which can be rectified before payment is made. Additionally, it is important to maintain good relationships with vendors and communicate effectively to resolve any issues or disputes that may arise. By implementing these strategies, a company can improve its financial health and maintain a positive reputation with its creditors.

A low Accounts Payable Turnover Ratio may indicate that a company is experiencing cash flow problems, supplier relationship issues or may be taking advantage of extended payment terms. It is crucial to compare the ratio with industry benchmarks and analyze the components of the ratio to interpret the results correctly. To demonstrate the turnover ratio formula, imagine a company’s total net credit purchases amounted to $400,000 for a certain period. If their average accounts payable during that same period was $175,000, their AP turnover ratio is 2.29. Some companies will only include the purchases that impact cost of goods sold (COGS) in their Total Purchases calculation, while others will include cash and credit card purchases. Both scenarios will skew the accounts payable turnover ratio calculation, making it appear the company’s ratio is higher than it actually is.

Phản hồi gần đây