In this article, three aspects of anti-dilution are discussed in more detail. Ask a question about your financial situation providing as much detail as possible. Investors can use this information to identify companies that are more profitable and have better financial performance. Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching. After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career.

Assumptions and Estimates in the Calculation

OBEX Group provides access to all of the resources, tools, execution platforms, and strategies you need to make informed financial decisions and maximize your use of capital. Our experienced staff, international and domestic relationships and exceptional service will help you and your business reach the next level of success. A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation.

Comparison of Fully Diluted EPS Across Companies

The smaller ownership percentage also diminishes each investor’s voting power. Public companies must report EPS on their income statement and include both primary and diluted EPS. Although news of a secondary offering is typically not welcomed by shareholders because of dilution, an offering can inject the company with the capital necessary to restructure, pay down debt, or invest in research and development.

Great! The Financial Professional Will Get Back To You Soon.

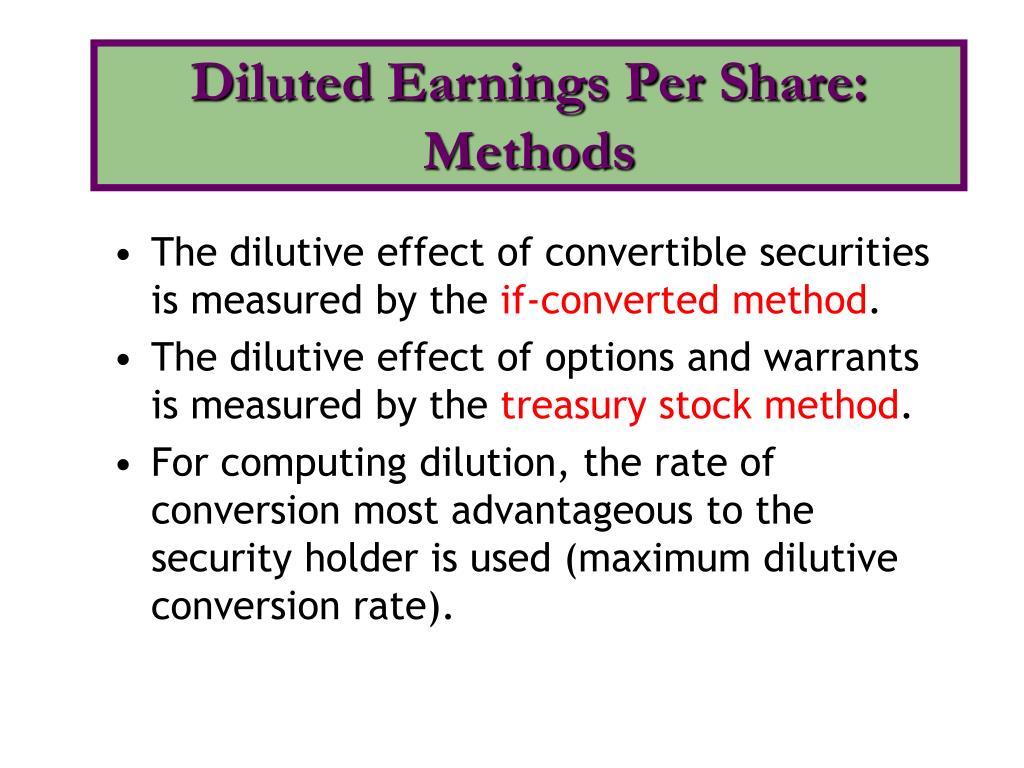

- These calculations involve bringing in the savings and new shares in order from the most to the least dilutive.

- However, a high diluted EPS with a small difference between it and basic EPS is preferable.

- Warrants are often issued as a part of a bond offering and can be exercised at a later date.

- For example, if a company has a one-time gain from the sale of an asset, it may inflate the net income used in the fully diluted EPS calculation.

- Investors can use this information to identify companies that are more profitable and have better financial performance.

Shares can also be diluted by employees who have been granted stock options. Investors should be particularly mindful of companies that grant employees a large number of optionable securities. Secondary offerings are commonly used to obtain investment capital to fund large projects and new ventures.

What is the approximate value of your cash savings and other investments?

11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links. These assumptions and estimates may not always be accurate, which can impact the accuracy of the fully diluted EPS calculation. Rights to purchase stock are similar to options in that they give the owner of the right the authority to purchase new common stock. Options allow holders to buy the share at a specific price and during a certain period. To understand how diluted EPS works, let’s look at the formula of diluted earnings per share.

A company must make adjustments to its earnings per share and ratios for its valuation when dilution occurs. Investors should look out for signs of potential share dilution and understand how it could affect the value of their shares and their overall investment. This means that, if converted, EPS would be higher than the company’s basic EPS. Anti-dilutive securities do not affect shareholder value and are not factored into the diluted EPS calculation. After all, by adding more shareholders into the pool, their ownership of the company is being cut down. That may lead shareholders to believe their value in the company is decreasing.

The EPS calculation takes into account the company’s net income and the number of outstanding shares. The fully diluted EPS calculation goes a step further and considers the impact of all potentially massachusetts state tax information on the number of outstanding shares. Common stock is obviously the most common dilutive security because any additional issuances of common stock will automatically raise the number of outstanding shares. The corporation’s stock that has been approved and issued is known as the outstanding shares. Investors or institutions own the corporation through its outstanding shares.

For example, each convertible preferred stock may convert to 10 shares of common stock, thus also diluting ownership of existing shareholders. The effect on the investor who held common shares prior to the dilution is the same as a secondary offering, as their percentage of ownership in the company decreases when the new shares are brought to market. Convertible preferred stocks are a type of security that can be converted into common stock at a later date. When convertible preferred stocks are converted into common stock, the number of outstanding shares increases, which can impact the fully diluted EPS calculation. There are various types of securities that could impact the fully diluted EPS calculation.

In simple terms, we call the financial instruments dilutive securities if they increase the number of outstanding shares. It means that such securities are those instruments that can easily convert into common shares. For example, suppose Company A has five existing shareholders, who each own 10% of the company. If Company A issued more shares to gain new shareholders, the existing shareholders would see their 10% ownership stake shrink as more owners bought in. If Company A had an antidilutive policy in place, they would need to offer the existing five shareholders the ability to buy more shares in order to maintain their 10% ownership in the company. Therefore, shareholders’ ownership in the company is reduced, or diluted when these new shares are issued.

Phản hồi gần đây