Now let’s assume a business want to determine what price to sell their consultancy services at to achieve a target profit of £50,000 for the year. The target profit formula is a way to figure out how many things you need to sell to make the money you want. Knowing exactly how each dollar is spent clarifies where you can cut back or invest more. Now, let’s check your understanding of calculating the target profit point. Target profit and cost-volume-profit analysis combined can offer useful information to the management for decision-making in the long term.

What is Target Profit in Accounting?

He has been the CFO or controller of both small and medium sized companies and has run small businesses of his own. He has been a manager and an auditor with Deloitte, a big 4 accountancy firm, and holds a degree from Loughborough super bowl 2021 commercials University. Draw the lines to represent the profits of products P2 and P3 ranked respectively according to the C/S ranking. The company wants to earn a profit of $80,000 for the first quarter of the year 2012.

Contribution margin method for target profit:

If the quantity needed to be produced and sold in order to earn the specific Target Profit is a decimal number such as 64.49, then the value should be rounded up to 65. Target profit acts as a benchmark against actual financial performance can be measured. For example, in a volatile market, businesses face uncertainties such as fluctuating costs or unexpected economic downturns. Plan Projections is here to provide you with free online information to help you learn and understand business plan financial projections.

Target Profit Analysis:

So the business needs to sell 9,091 units in order to make the targeted profit of 15,000. Fixed costs like rent won’t change with sales levels, making them predictable partners in this equation. Firms keep an eye on profitability through these reports, ensuring they stay on track with their financial goals. Our blog post goes beyond just explaining what target profit is; we’ll provide a practical guide designed to navigate through its calculation effortlessly.

By providing a clear understanding of the relationships between different financial variables, it enables managers to make data-driven decisions. This level of detail ensures that decisions are not based on intuition alone but are backed by rigorous analysis. In the dynamic world of business, understanding your company’s financial health is crucial for success.

Price Elasticity of Demand

- Calculate the number of units which the company should produce and sell next year in order to achieve the target level of profit.

- Break-even analysis is a fundamental tool for businesses to understand the point at which total revenues equal total costs, resulting in neither profit nor loss.

- If the company ABC had set a target point, the crossing point at the x-axis will represent the required sales to achieve that target profit.

- Additionally its product sells for 15.00 and costs 6.75 to produce, and it has fixed costs of 60,000.

- For example, if a company notices an increase in the sales of a high-margin product, it can expect an improvement in its overall profit margins.

- Unit variable costs and production volume will remain constant and in proportion as the production level changes.

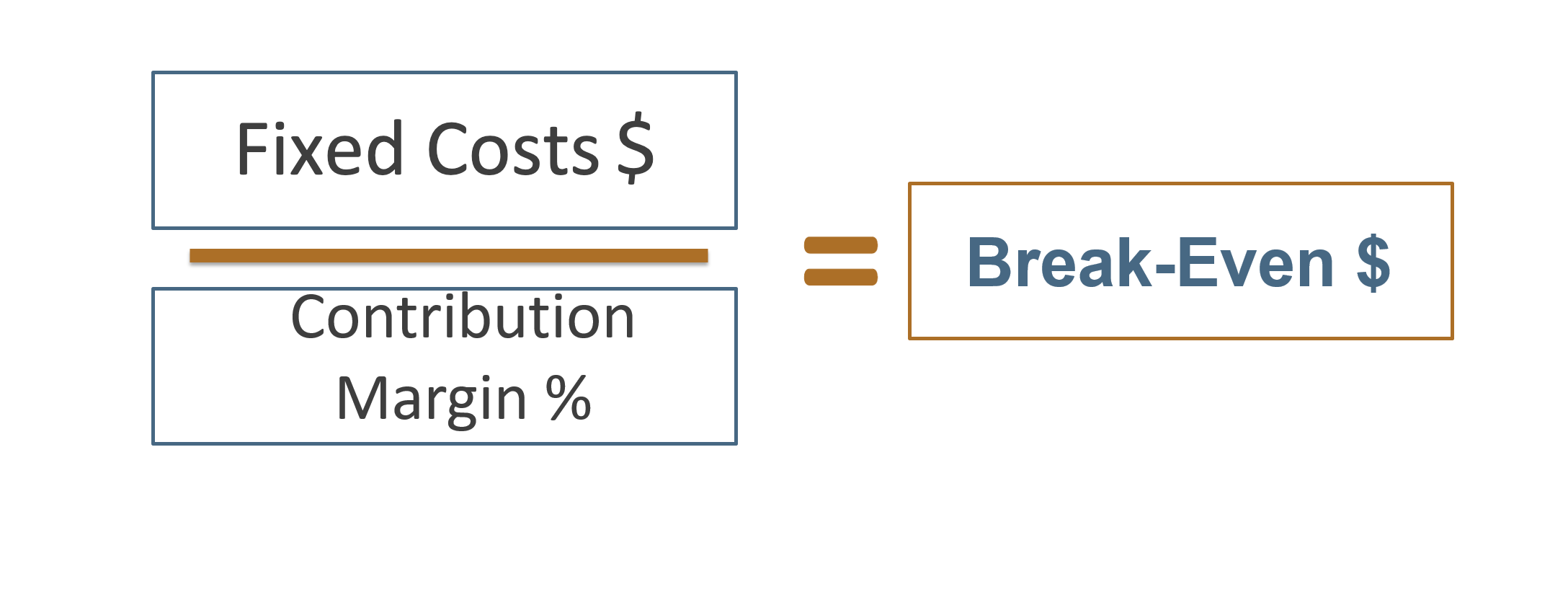

It is the next step for the organizations after the break-even platform where the revenue from the sales is only able to cover fixed & variable overhead without any profit. Still, in the target profit analysis, the company’s target is to earn the targeted profit over and above the expenditures. The second method is to first calculate the contribution margin and then set a target profit. The contribution margin is the revenue minus variable costs of production.

As you continue to refine your approach to calculating and leveraging profit percentage, you’ll develop a more nuanced understanding of your business’s financial dynamics. This knowledge will empower you to make more informed decisions, optimize your operations, and ultimately drive sustainable growth for your company. Target profit analysis helps us to know how much in dollar sales a company will need to reach a certain profit point. Once the basic data is calculated, it can offer a great deal of insight and help in planning. By establishing a target profit, businesses gain insights into the minimum revenue required to cover costs and generate the desired profit margin.

Overall, the target profit analysis helps the company identify its mission for the targeted period through evaluation of its overheads and profit-making ability. The usage of this method has been increased and adapted from large profit-making companies to the dormant ones. The regular update of the existing scenario helps it be a realistic analysis and more accurate to show low variation compared to actual results.

Net Profit Percentage, which we calculated above, takes into account all expenses. Get inspired with growth insights & tips from experts in the marketing industry. And, it is possible to use the Break-even Chart to find out the level of sales that the business needs to earn a certain amount of Target Profit. This allows businesses to assess whether they are on track to meet their goals, or an early warning signal if strategic adjustments are needed.

Phản hồi gần đây